- Blue Streak by Kyan

- Posts

- Friendly Liquidations on Kyan

Friendly Liquidations on Kyan

Kyan's liquidation engine aims to preserve as much of your portfolio as possible while restoring your account to a healthy state. Trade options, perps, and multi-leg strategies seamlessly with CEX-tier performance on Kyan.

Liquidations are one of the most critical and least pleasant aspects of trading on margin. For many traders, they represent sudden losses, forced selling, and little to no time to react. With Kyan, we’ve taken a different approach.

Instead of treating liquidation as a blunt-force exit mechanism, we’ve designed our system to act as a safeguard, not a punishment. Kyan’s goal is to restore the portfolio to a healthy state while preserving as much of the user’s capital and strategic intent as possible. This means giving the trader time to react, targeting risk in smarter ways, and only escalating liquidation when absolutely necessary.

Let’s take a closer look at what this means, how it works, and how Kyan gives users more time and flexibility when their margin runs low.

Before you scroll down, sign up on kyan.blue to stay up-to-date with Kyan’s development and the upcoming beta event.

Margin Ratios on Kyan

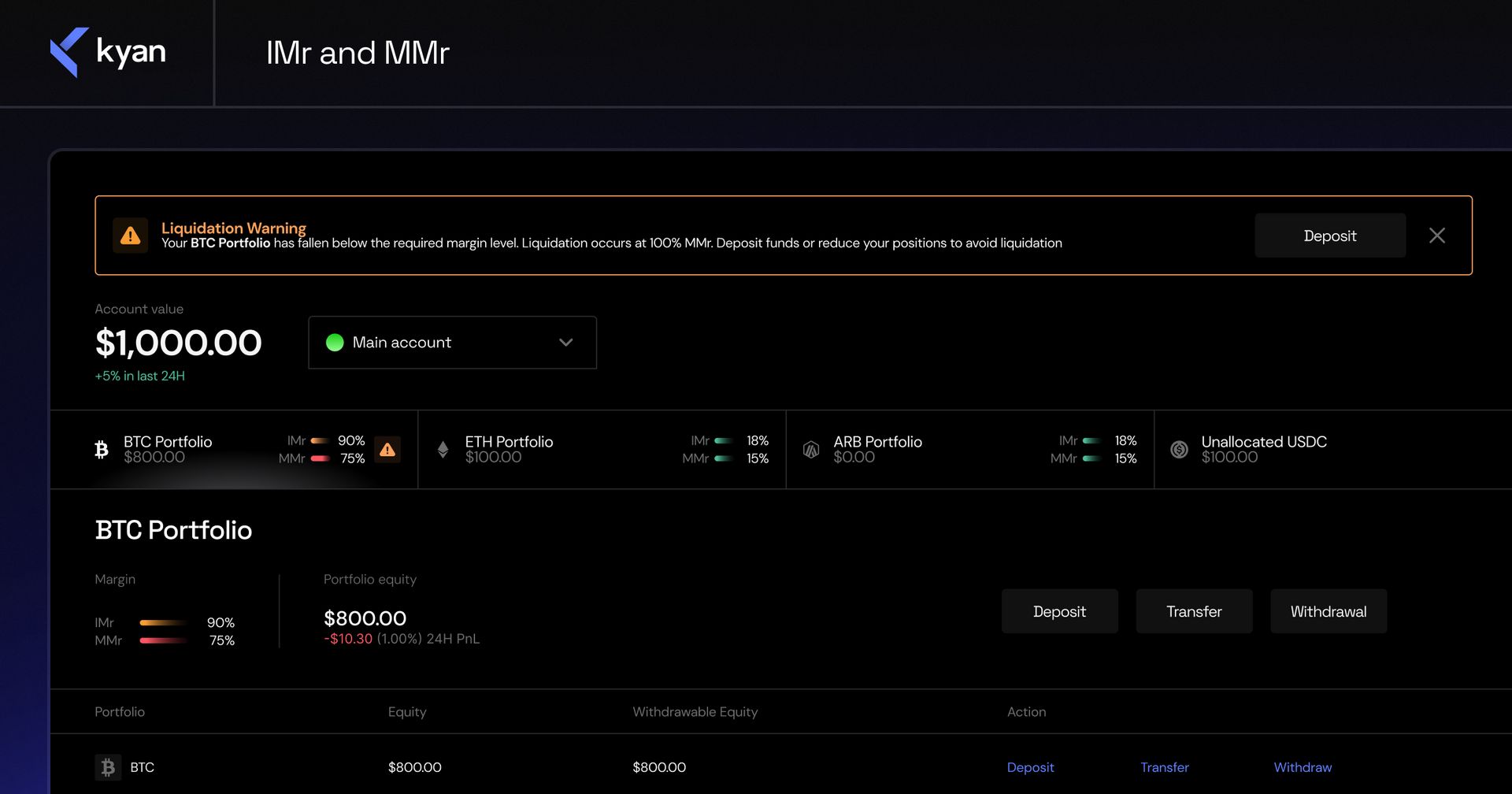

To understand how liquidations work on Kyan, it helps to know how margin is calculated. Kyan’s risk engine continuously monitors each portfolio on the platform and uses two key metrics:

Initial Margin Ratio (IMr): This ratio measures how close the portfolio is to reaching its maximum allowable directional risk. When IMr hits 100%, the user can no longer increase exposure, but they can still open new positions to reduce risk or deposit more equity. It’s a warning signal, not a shutdown.

Maintenance Margin Ratio (MMr): This is the critical metric. It measures how close the portfolio is to liquidation. Once MMr exceeds 100%, it means the portfolio no longer meets the minimum required equity to support the positions. At this point, the liquidation engine activates to bring the account back to a healthy state.

The Friendly Liquidation Process

Kyan’s liquidation engine doesn’t rush to sell everything. Instead, it evaluates the portfolio and targets specific components that can reduce risk with minimal disruption. This tiered process helps maintain the integrity of open strategies, especially multi-leg positions, while working to bring the account back within healthy margin levels.

Here’s how it works:

Step 1: Delta Hedging or Perp Liquidation

The first move is to reduce directional risk by delta hedging. This step alone is often enough to bring the portfolio back to a healthy state without touching the user’s core strategies. It’s fast, low-impact, and preserves the structure of most multi-leg positions.

In this step, Kyan opens additional positions to offset the portfolio's directional exposure, unless the account is perp exposure only. For those accounts, Kyan will liquidate the entire position.

Step 2: Portfolio Decomposition

If delta hedging isn’t enough, the system begins unwinding specific components of the portfolio. It starts with the least impactful trades, such as synthetics, vertical spreads, and standalone options, using a greedy algorithm that targets the most risk-reducing trades first.

This approach preserves the most complex strategies as long as possible. Trades are sent to the market gradually using limit orders. If they don’t get picked up, incentives increase over time until the orders are executed.

Step 3: Full Liquidation (as a Last Resort)

If none of the above steps restore a healthy margin and no one takes the orders, the account may be flagged as bankrupt. In this rare case, Kyan’s insurance fund steps in to take over the remaining positions.

A System Built for Traders

What makes this liquidation system “friendly” isn’t just the mechanics. It’s the intent. By prioritizing smart, staged unwinding of risk rather than wholesale liquidation, Kyan gives traders the best possible chance to recover and retain their capital.

Even when liquidations happen, Kyan offers transparency, time, and opportunity: time to react, opportunity to reduce risk, and a system that works with the trader, not against them. Along with real-time IMr and MMr feedback, this system is designed to minimize unnecessary losses.

Whether you’re building complex multi-legs or running a directional strategy, you can trade with confidence, knowing that the platform is engineered to protect your positions, not liquidate them at the first sign of volatility.

What Does Kyan Mean for Crypto Options?

Kyan will be a significant upgrade for anyone trading decentralized derivatives.

Reply