- Blue Streak by Kyan

- Posts

- Monday Alpha #10

Monday Alpha #10

Vol news, charts and thoughts on DeFi options trading in our Monday Alpha by Premia x Marty!

We are at number 10 of the Marty Monday Alpha newsletter!

As it’s Monday, lets keep it short. If there is something you would like us to cover or go over, feel free to reach out. Marty’s Twitter DMs are always open.

Please note that Premia does not provide investment advice, and nothing herein should be construed as such. Anyone considering trading or holding derivatives or crypto assets should be aware that the risk of loss can be very high, and it is upon each individual to seek advice from an appropriate professional advisor.

TLDR: Prices Climbed - IVs Popped.

BTC ATM IV

1W: 52.83%

1M: 54.75%

3M: 58.98%

6M: 61.77%

Index Price: $36,836

DVOL: 57.32

ETH ATM IV

1W: 57.22%

1M: 58.58%

3M: 62.45%

6M: 64.84%

Index Price: $2,051

DVOL: 60.51

Things To Pay Attention To

11/14 Tuesday

U.S. CPI - 8:30am EST

11/15 Wednesday

U.S. PPI - 8:30am EST

BTC and ETH Prices

BTC, ETH, NQ, and Gold Prices

Risk asset froth is finally back pimps.

Crypto majors have been running since late October with ETF news across all fronts. Meme coin speculation is back, and some tech stocks are making new all time highs. Are we in for a Santa rally?

30 day correlation BTC-NQ, ETH-NQ, Gold-BTC, BTC-ETH

30 day correlation BTC-ETH

30 day correlation BTC-NQ, ETH-NQ

We have been covering the 30 day correlation chart for a while now, but really started to focus on it when the BTC/ETH correlation fell off. And as we can see, it's fully back.

We highlighted this when ETH/BTC price was in free-fall as well, we have since seen a bounce in that pair. I wanted to break down the 30 day correlation chart in various segments highlighting different correlations as the main one with all 4 correlations can get cluttered.

We are now seeing BTC/ETH back in correlation, with crypto majors and NQ in no mans land. We will continue to watch and update our readers on these charts. Should we release this chart in real time for our readers to monitor and use?

This week GreeksLive reported an impressive trading volume, surpassing 80 million USD in notional value over the past week.

Although this figure doesn't represent their ATH weekly notional volume, it's still a significant milestone worth highlighting. To provide a deeper insight into their trading activities, we've compiled and analyzed their five largest block trades from the last week. Our aim in showcasing these substantial orders is to offer our readers a window into the strategies and movements of major market players.

This week's trading patterns were particularly intriguing, marked by a mix of strategies. Notably, there was a trend towards call spread buying in ETH, suggesting a bullish outlook among traders. In contrast, BTC saw a rise in outright put purchases, indicating a more cautious or bearish sentiment.

These contrasting strategies in ETH and BTC markets offer a fascinating glimpse into the diverse approaches taken by large-scale traders in the current market landscape. It's also worth mentioning that we don’t have insights into these traders’ full books.

To Join Greekslive Block Marketplace: t.me/GreeksLive

Find Greekslive On Twitter: https://twitter.com/GreeksLive

BTC IV vs HV

ETH IV vs HV

Prices climbed — IVs popped. We saw BTC DVOL hit 65 handle, and ETH DVOL 66 handle.

We have since seen IV’s fall from those peaks. The spot ETF is still pending approval and still feeling like now is not the time to sell volatility until we see approval and realized flows of these products.

It may still just be hopium and a sell the news event as we find out no one is actually interested in trading these products, and all the build up was for nothing.

We await some more clarity, but for now market feels risk on across the board for all risk assets.

BTC Gamma Exposure by Strike

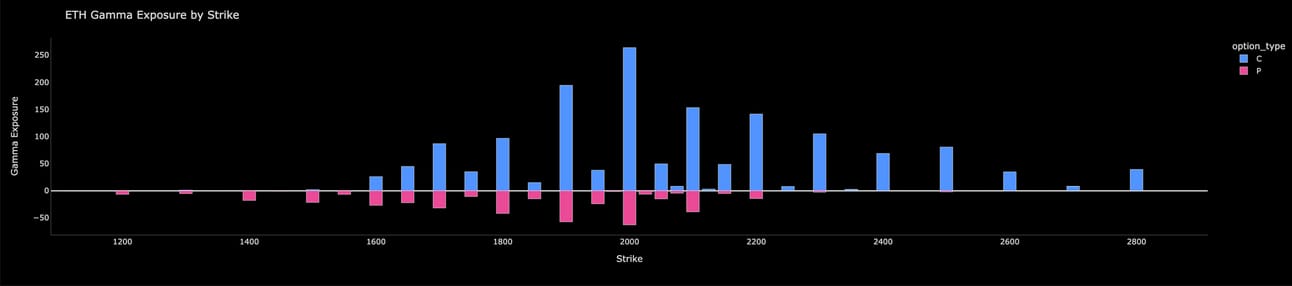

ETH Gamma Exposure by Strike

Areas Of Interest:

40k BTC

2000-2400 ETH

As the market observes an uptrend in pricing, traders are increasingly focusing on potential gains, with specific attention on key levels like 40k BTC and 2k-2.4k ETH. These figures represent significant areas of interest in the current trading landscape.

Additionally, there's a growing interest in more ambitious, higher strike prices, particularly in the range of 50k to 55k for BTC. These further out strikes are mostly for longer dated expiry. This trend doesn't necessarily predict the future direction of prices, but rather highlights the Gamma exposure associated with these specific strike levels.

The anticipation surrounding several pivotal events is also influencing market sentiment. The U.S. financial market has yet to approve a spot ETF for cryptocurrencies. The possibility of such an approval, combined with other major factors like the upcoming BTC halving, potential changes in macroeconomic policies, and the 2024 presidential election in the U.S. is fueling speculation and interest in risk assets.

These events are seen as potential catalysts that could significantly impact the crypto market, prompting traders to speculate on the future direction and volatility of these assets.

Wrap-Up

Areas of Interest:

BTC: 40k

ETH: 2k-2,4k

Recap:

IVs fell off the peak

Waiting to see real ETF flows before deeming these ETF products our savior.

Premia Blue is the first non-custodial options settlement layer with fully customizable options parameters and risk exposure.

Maximize capital efficiency, define your own risk, and optimize fees earned with Premia Blue on Arbitrum!

Reply