- Blue Streak by Kyan

- Posts

- The BTC and ETH Bullrun? | The 50th Edition

The BTC and ETH Bullrun? | The 50th Edition

TL;DR: The Big Five O

Please note that Premia does not provide investment advice, and nothing herein should be construed as such. Anyone considering trading or holding derivatives or crypto assets should be aware that the risk of loss can be very high, and it is upon each individual to seek advice from an appropriate professional advisor.

TL;DR: The 50th Edition of Monday Alpha

BTC ATM IV

1W: 33.06%

1M: 34.28%

3M: 40.42%

6M: 44.56%

Index Price: $119,838

DVOL: 37.27

ETH ATM IV

1W: 68.68%

1M: 69.19%

3M: 66.24%

6M: 68.46%

Index Price: $4,296

DVOL: 66.93

Marty's Thoughts / Recap

Things to watch out for:

Tuesday Aug 12: US CPI

Thursday Aug 14: US PPI

CME FED WATCH TOOL: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

This tool is free, we have covered it a few times in previous newsletters. All eyes are on the September rate cut which is sitting around 86.4% chance of an Ease, 13.6% chance of No Change, and 0% chance of a Hike. This is a great tool to see real market sentiment instead of Twitter slop. There is a 95% chance of a cut in October, and 99% chance in December. Of course, the market will slowly start to price those cuts in, I think we are seeing this now in the markets.

Tomorrow, Tuesday Aug 12, we have US CPI numbers coming in, its expected +2.8% y/y vs the previous +2.7% y/y. This data point tomorrow will really shape up our final expectations of Septembers FOMC meeting.

As for currently, price of majors are up, alts are getting rinsed -10%, and US futures are trading down -0.08%. Seems to be a little bit of chop chop before tomorrows data point.

Lets recap from the last newsletter. We covered Institutional trading desk dropping Eth services at the pico bottom, US data points coming in, and that it was going to be a big big week… Well fellas… Eth ran to almost 4300, and BTC ran just over 122k. Eth has been on a ripper, but leaving most of the alts behind. The rotation used to be BTC ran first, followed by ETH, then shitters followed… but Eth has just decided to join the Bullrun but just for BTC party. I guess we can now call it the BTC and ETH bullrun.

For our long term readers, you know we only trade BTC and ETH and stay away from the shitters. I would like to have a few trench warriors on the Eden or Marty Show to give us some insights, alpha, and stories of their ups and downs.

2-Week Crypto Returns (Large Caps)

2-Week Crypto Returns (Mid Caps)

2-Week Crypto Returns (Small Caps)

Charts from Velo: https://velodata.app/

Twitter: https://twitter.com/VeloData?s=20

Marty’s Thoughts

Looking at the charts above you wouldn't think this is a bull run anymore… It just seems to be the ETH show the last 2 weeks. We had every bit of good news for ETH possible. ETH Treasury companies sprouting out of the ground like weeds, ETH Founders on the news shilling to the public, ETH doing more volume than BTC, and mass short liquidations to fuel the fire.

Pull that chart up Jaime.

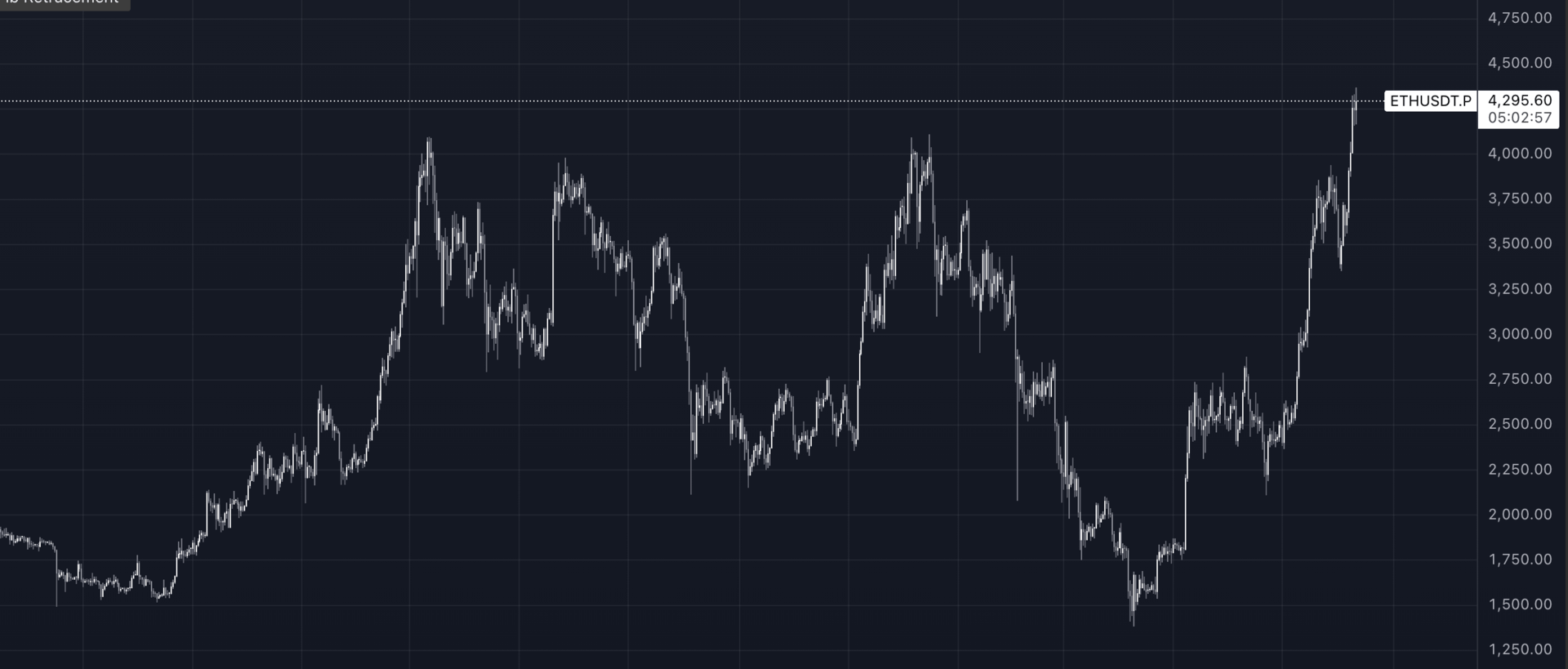

ETH Daily

ETH bros in control. From April when ETH hit $1400 to now hovering around $4300, it has been a wild ride. But is it over? I suspect not… But this comes with a catch, this is crypto. Crypto is the last free market. It is the first to move, and moves the most out of other markets. Just as fast as things can move up 50%, they can go down 50%. If you are now just trying to catch the ETH train, it probably isn't the smartest route to be.

Let’s dig into the vols a little. Lets just use Deribit's DVOL for BTC to keep it simple. Vol is meant to be sold, we all know this. But SOMETIMES it is meant to be bot. We are sitting at almost All Time Low Levels… Levels not seen since Aug/Sept 2023. This is something to pay attention to and to reposition your book to account for…. As Loris says, vol is meant to be sold, until it isn't, then you get ran over by the steamroller.

I’m not expecting 100v asset again, but a nice rise into 40/50 could go a looong way for your positions. I wouldn't look for outright calls here… I would more look for various types of spreads with a wide payout range. These types of plays are not 1DTE type plays, usually look out 1-2 quarters and size in.

BTC 24HR Top Volume Options Trader

ETH 24HR Top Volume Options Trader

Quick Note... there was a large player in ETH that was long December 3200/3500-6000 Call spreads bought in May this year. The godly trader appeared again. He cashed those plays from May, bot December 4k Calls, 4000/6000 Call Spreads, and 5000/7000 Call spreads, all for December.

We were all laughing in May at this trade when Eth was sitting at 2500ish when the trade was put on, but my god did he cash. We will keep an eye on ETH price and this guys trade if he decides to unwind or roll into something else.

Final Thoughts

As we look into 2025, Premia V4 aka Kyan will be launching. With portfolio margin and perps, it will be a great place to check out, trade, and compete in future competitions for rewards.

As V4 comes into the public eye in testing shortly, we would love all of your feedback. I’ll work with the team on finding the best way to share bugs and feedback from our readers. If you have any good ideas, please share.

For now, if you are interested in learning the basics of derivatives, please check out current edition of the academy here academy.premia.blue (currently undergoing maintenance, so some courses might be unavailable). We are going to be launching a whole new academy for V4, with more up to date and more in depth content.

Thank you to all the readers who make this newsletter possible, this is our 50th Edition, we are sitting at about 4000+ email sign ups, and thousands of readers every 2 weeks. As for the Options Talk Show if you or someone you know wants to be a guest feel free to DM me, we are booking out December 2025 already!

Note: email sign ups get the newsletter 20ish minutes before.

Recap:

Eth trader positioned for Santa Rally

CPI/PPI This Week

Vols At All Time Lows, Time To Pay Attention

50th Edition of the Newsletter

Trade on Premia: https://app.premia.blue/

Join The Marty Community Telegram: https://t.me/optionswithmarty

Mind you there is never a paid group, all information is free and we will never ask you for money. The Telegram is always free and provides a community for people to chat and learn.

Reply