- Blue Streak by Kyan

- Posts

- The Institutional Playbook Continues | Monday Alpha #52

The Institutional Playbook Continues | Monday Alpha #52

Vols keep sliding, SOL is running the BTC/ETH institutional playbook, Nasdaq is inching toward tokenized securities, and big U.S data next week sets the stage.

BTC ATM IV

1W: 33.13%

1M: 35.72%

3M: 38.95%

6M: 42.24%

Index Price: $112,679

DVOL: 36.97

ETH ATM IV

1W: 63.57%

1M: 64.51%

3M: 65.52%

6M: 66.35%

Index Price: $4,373

DVOL: 65.07

Things To Watch:

Sept 10: US PPI

Sept 11: US CPI

Sept 17: FOMC

Marty's Thoughts / Recap

They are officially running the same playbook with SOL. In our last newsletter we said "First they did the playbook with BTC, then ETH, so what's next… dare I say they do it with SOL? I wouldn't doubt it. If there's a product to sell and make money, these guys will sell it.”

Today the news dropped that Jump, Multicoin, and Galaxy are launching a Solana Treasury company with $1.65B in cash. With this news breaking, others will quickly follow suit. Over the past two weeks, BTC has been flat, ETH is down, and SOL is positioning itself for a breakout. With new institutional inflows and fresh hype building, I expect the price to keep climbing. But as always, hype eventually fades and we need to see real innovation and actual use cases, not just capital being thrown around, for the sustained growth we're looking for.

We also got some positive news from NASDAQ this morning: tokenized securities will be traded on the same order book with shared execution as traditional securities on NASDAQ if certain conditions are met.

This could be a game changer for bridging traditional and digital assets.

I'm particularly interested to see how this plays out and how quickly the system adapts to tokenized securities. The integration will likely require significant infrastructure updates to handle 24/7 trading cycles, smart contract settlements, and regulatory compliance across both traditional and digital frameworks. Market makers will need to adjust their strategies for assets that can trade around the clock, and we'll probably see new clearing and settlement mechanisms emerge. The real test will be whether institutional traders embrace the efficiency gains or if regulatory hurdles slow adoption. Either way, this represents a major step toward the convergence of traditional finance and blockchain technology.

Note 1: Robinhood announced Robinhood Chain which uses Arbitrum to start offering their products, they are on the forefront of the onchain and tokenized stocks movement. Though the Arbitrum news dropped a few weeks ago, they are up 15% today on this new NASDAQ news.

Note2 : It would be funny if they brought all this new tech and didn't trade 24/7.

BTC, ETH ATM IV continues to slump.

Looking at the ATM implied volatility charts, we're seeing a clear downward trend across both BTC and ETH. ETH's IV has dropped from around 75 handle in late August down to the mid 60s, while BTC has fallen from the low 40s to the mid 30s handle. This IV compression tells us the options market is pricing in less expected volatility ahead, which typically happens when uncertainty fades and markets stabilize.

The consistent decline across all time frames suggests this isn't just short term noise but a broader shift in market sentiment. Lower IV means cheaper options premiums, which could present opportunities for those looking to get positioned. However, it also indicates the market expects less dramatic price swings in the near term. I am all for a vol down, price up situation Keep an eye on this trend because when vols gets too low, it often sets the stage for surprise moves that catch everyone off guard… which we have seen over and over again.

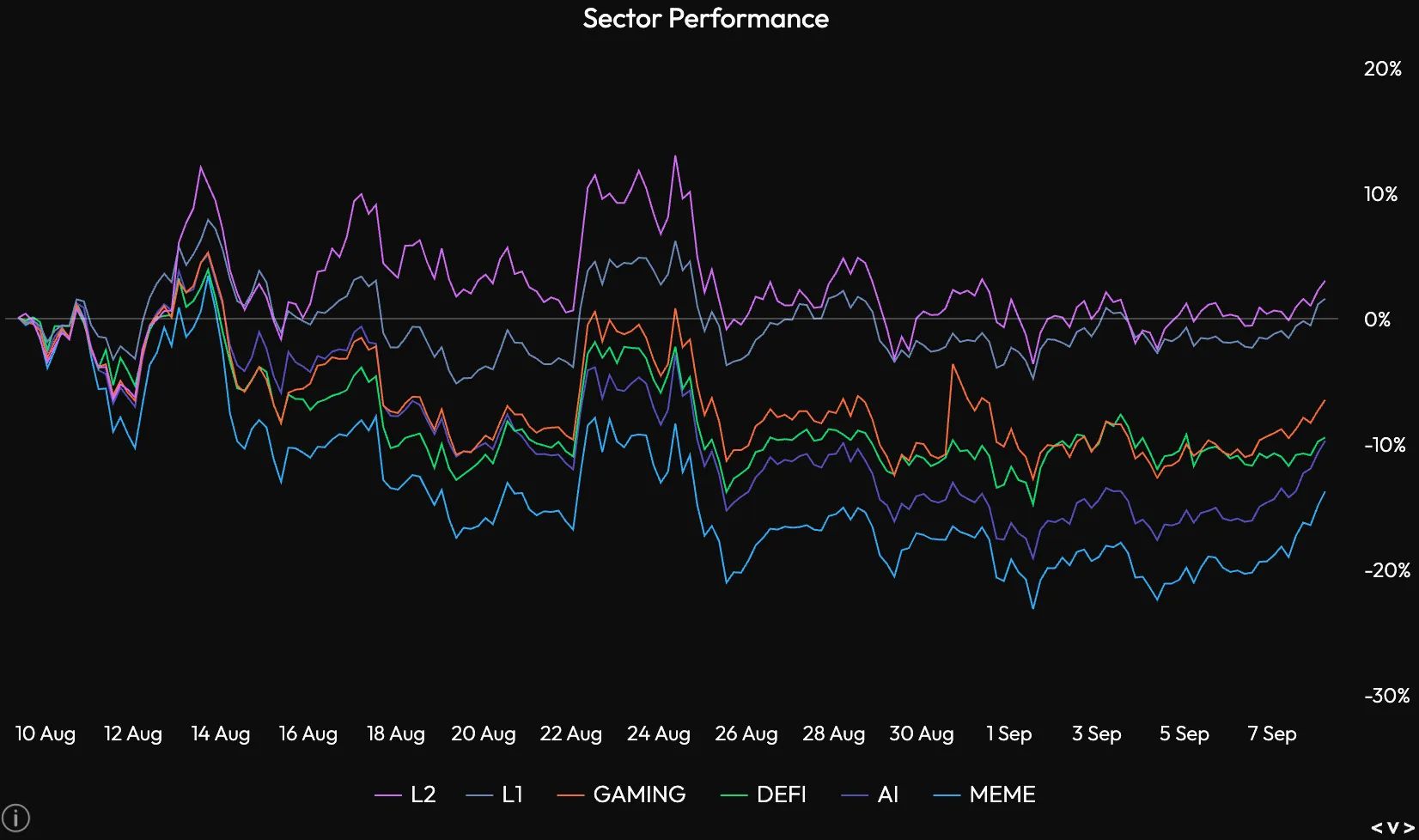

1 month returns look similar to our last newsletter, mostly red with some green sprinkled around. Is the alt season in the room with us now?

Quick Chart Dump

L2 category takes the crown barely, the rest are finally catching up, but still down a lot.

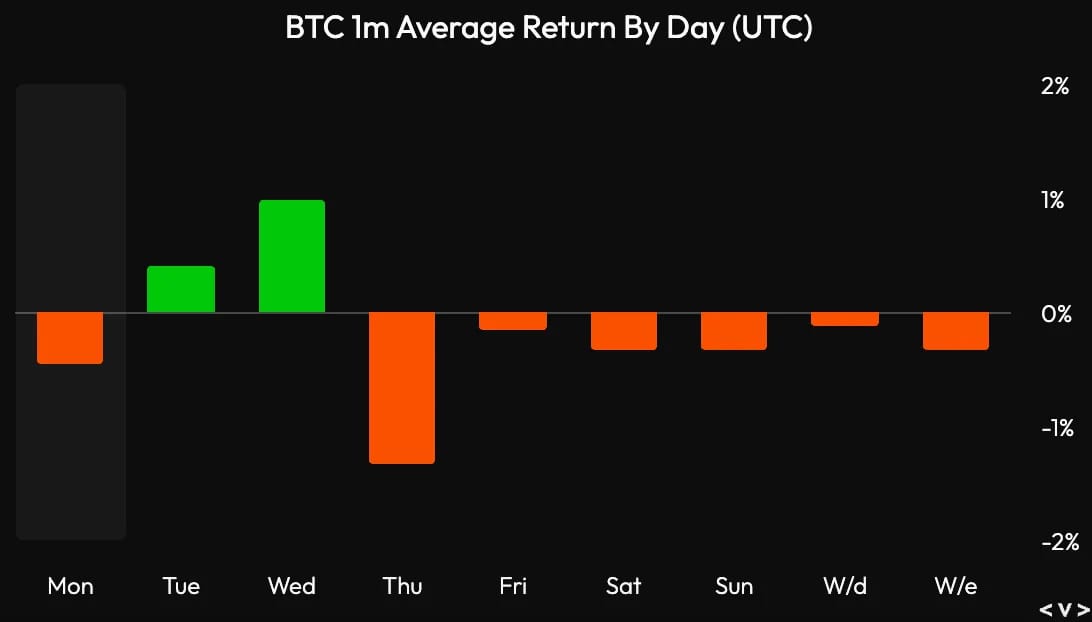

Nothing out of the ordinary here… Nothing too hot, nothing too cold.

Charts from Velo: https://velodata.app/

Wrap-up

My next 2 long form articles are coming out soon. Mr. Weka my Editor In Chief is starting to review the initial drafts. One will be about Structured Products, with the other covering The 4 Year Cycle accompanied by my insights and thoughts on those topics.

I think that while structured products are more used by institutions, they just haven't gotten the spotlight yet and it is just a matter of time until we start seeing an uptick in those derivatives offerings. Look out for those long forms coming out in the next few weeks! We will of course share them here and on all the Marty and Kyan socials!

As for my current views on the markets… let’s keep it short. Everyone knows that they are cutting in September for FOMC… How much? 25bps? 50bps? I’m in the camp that it’s 25bps, if it’s 50bps right off the bat then it doesn't give me too much confidence… Remember that the market is not the economy.

As for all the latest IPO and coin offerings…. they just look like a cash grab… WLFI, BMNR, SBET, BLSH… and all the others are just either down only, filled with drama, not bringing anything positive to the market… or a mixture of all of the above. If I was going out and trying to pick single name stocks or coins I would be very skeptical of these types of predatory offerings. You are probably better off buying BTC or ETH… NFA of course.

Everyday we see new innovation in the space and new talent flocking to crypto. Crypto used to be dismissed as a meme by institutions and retail alike, but now we're at a tipping point. Institutions recognize they can invest, build, and profit from new offerings in ways that weren't possible just a few years ago.

Alongside these institutions are the DeFi projects that have been here for years, quietly building and laying the foundational infrastructure that these traditional players now depend on to onboard and scale their operations. What's fascinating is watching this convergence play out in real time. The same protocols that were considered experimental are now handling billions in institutional capital.

This shift represents more than just adoption… it's validation for the entire crypto ecosystem. The infrastructure is mature enough, the regulatory clarity is improving, and the profit potential is undeniable. We're witnessing the transformation from a speculative asset class to legitimate financial infrastructure that traditional finance can't ignore anymore. The question isn't whether institutions will continue entering the space, but how quickly they can adapt to keep up with the pace of innovation.

As we look into 2025, Kyan will be launching. With portfolio margin and perps, it will be a great place to check out, trade, and compete in future competitions for rewards. Majority of my 3rd and 4th quarter will be working with Mr. Weka writing educational content including more long form, advanced topics, and How To tutorials. We may even do some videos as well for all to learn easily. If there is something you want to see us write about and put in there, please reach out. For now, if you are interested in learning the basics of derivatives, please check out current edition of the academy here academy.premia.blue.

Note: Email sign-ups get the newsletter 20ish minutes before.

Recap:

Vol slipping

Same Playbook Being Ran On SOL

Is The Altcoin Season In the Room With Us?

Huge US Data Coming Next 2 Weeks

Trade on Premia: https://app.premia.blue/

Join The Marty Community Telegram: https://t.me/optionswithmarty

Mind you there is never a paid group, all information is free and we will never ask you for money. The Telegram is always free and provides a community for people to chat and learn.

Reply