- Blue Streak by Kyan

- Posts

- Tuesday Alpha #47

Tuesday Alpha #47

TL;DR: Chippity Chop, Vols Slide

Please note that Premia does not provide investment advice, and nothing herein should be construed as such. Anyone considering trading or holding derivatives or crypto assets should be aware that the risk of loss can be very high, and it is upon each individual to seek advice from an appropriate professional advisor.

TL;DR: Chippity Chop, Vols Slide

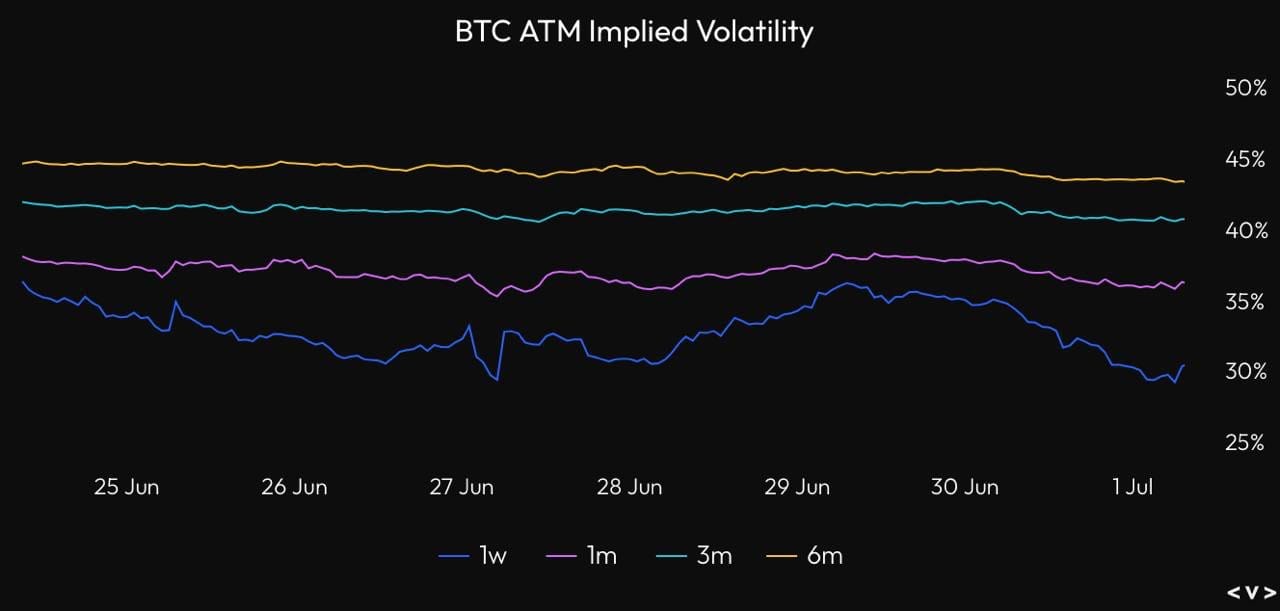

BTC ATM IV

1W: 29.64%

1M: 35.87%

3M: 40.62%

6M: 43.46%

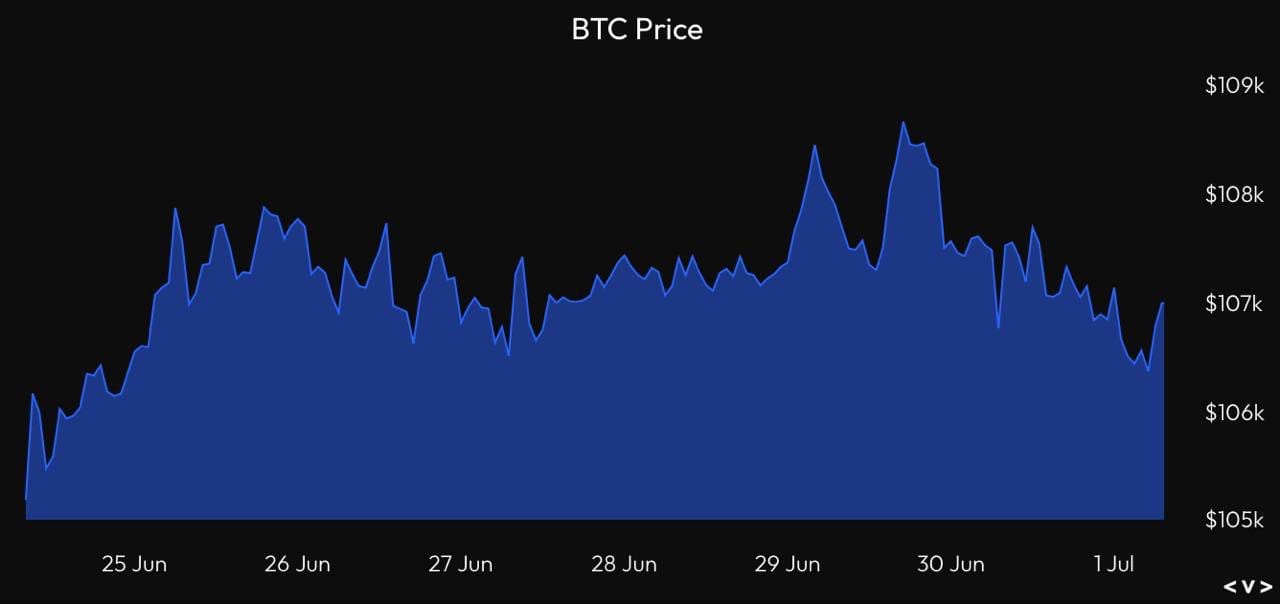

Index Price: $106,400

DVOL: 37.31

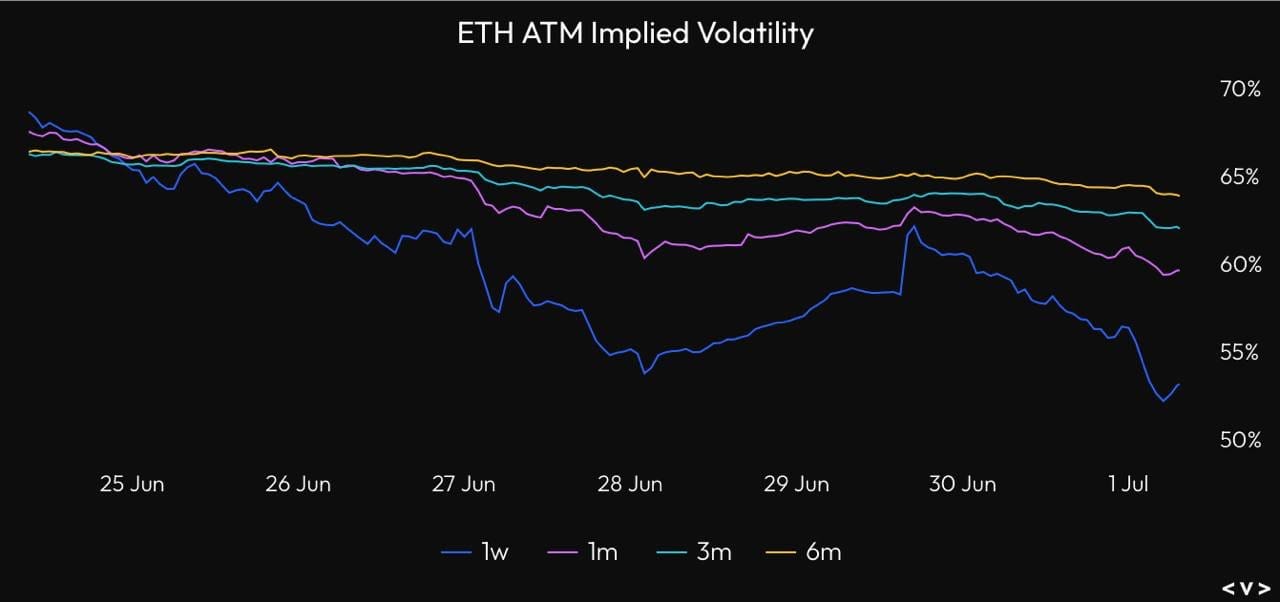

ETH ATM IV

1W: 52.74%

1M: 59.43%

3M: 62.08%

6M: 63.99%

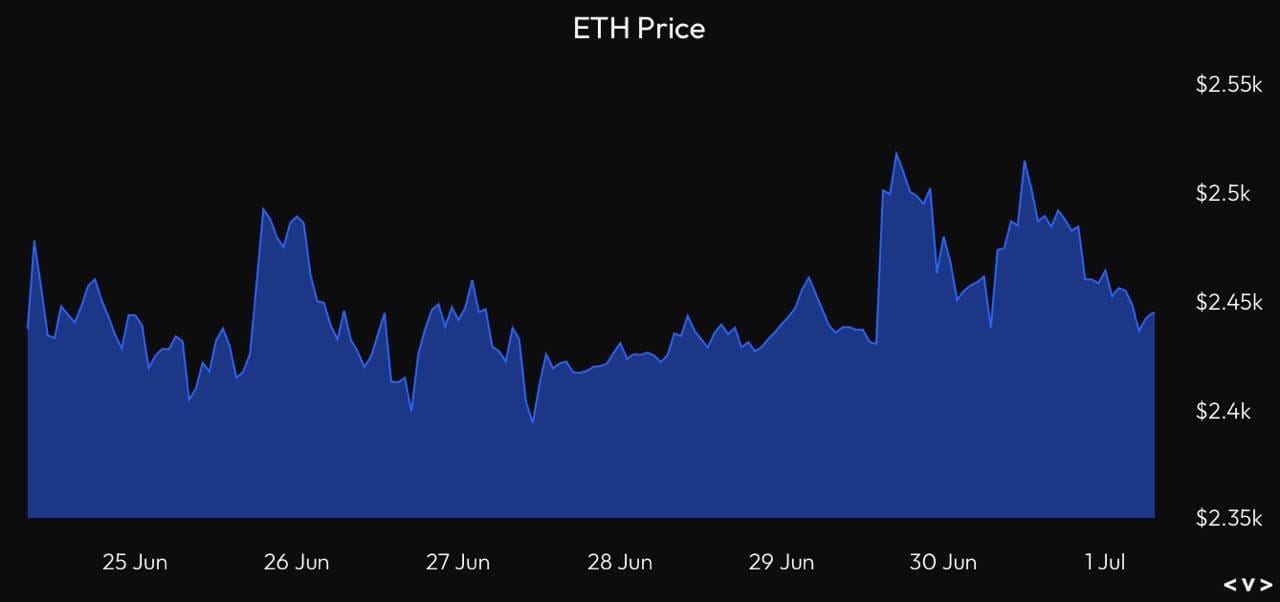

Index Price: $2,442

DVOL: 61.34

Note: ETH front-end finally back in line.

Marty's Thoughts / Recap

Sorry fellas and long term readers for the delayed newsletter as yesterday was a nightmare from hell with no WiFi on a 12+ h flight.

FOMC news came as expected, with no new shock to the market, and the volslide has begun. We have seen ETH front-end be mega lifted over the past couple newsletters, this week finally falling back in line. As price continues to chop and the month comes to an end, where does that leave us? Do we have a catchy name for July yet, as we did with Joyful June?

As we go to check in on price, every dip gets bid, and every dip gets sold, keeping us at prices seen since early/mid May. We are just covering BTC and ETH here. As we look forward to the macro landscape, there are some things to pay attention to. The Big Beautiful Bill being one of them. The White House is saying one thing, and the CRFB and Congressional Budget Office are saying another, both taking jabs at one another. Honestly, it’s like a reality TV show.

I’m not one for theater politics, and we should really get down on the nitty gritty. I’ll do a deep dive on the bill and see which side I’m on for the next newsletter. One side saying it will add $3 TRILLION to the deficit, the other other saying it will not. It seems like it should be quite easy to see if $3 trillion is being added or not.

If adding to the deficit and rate cuts are coming, then you know what that means… The golden bull continues. Let’s keep it simple. Rates coming down and money being injected = up.

Check out the below for the political drama happening right before our eyes.

The White House: https://www.whitehouse.gov/articles/2025/06/myth-vs-fact-the-one-big-beautiful-bill/

BTC and ETH vols continue to slide post WW3 scares and FOMC passing. As noted in the last newsletter, we are still positioned in September/December upside with various structures. While vols are this low, we continue to sell vol too in our treasury management services gigs. Of course, none of this is financial advice, and positions can flip quick, but with a low vol summer, I would love to see the markets pick up into Q4 this year. When things are this stale, flat, vols dead, it’s a good time to see if the market offers any good longer term plays that you as a trader can put on and profit from.

Last newsletter I went full Middle-East-crisis-expert, and I’m glad the region has found stability and we can continue the slow grind up. We shouldn’t kill others for any reason, let alone fire insane missiles and drop big bombs. As WW3 comes to an end, let’s look forward to the positive things we have coming this year:

This Thursday July 3rd before the US holiday: Nonfarm Employment and Unemployment Rate

July 9th : FOMC Minutes

July 15th : CPI

July 29th : JOLTS

July 30th : FOMC

One thing to keep in mind is all this Biden/tariff overhang and to see if it comes in on this CPI or if we come in cool again. (The Biden overhang is a joke, but the tariff overhang is real.) With JOLTS, I’m expecting a whipsaw reaction, but all eyes are on the prize. When it comes to FOMC, according to the CME FedWatch tool, there’s a 78.8% no change, BUT a 21.2% chance of a cut. We got hope boys! Let’s continue to watch this change in the next newsletter. If the market is predicting more and more cuts, then expect this news to be somewhat frontran. Of course, nothing is certain until JPow’s conference and of course the color tie he is wearing.

CME FedWatch Tool: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

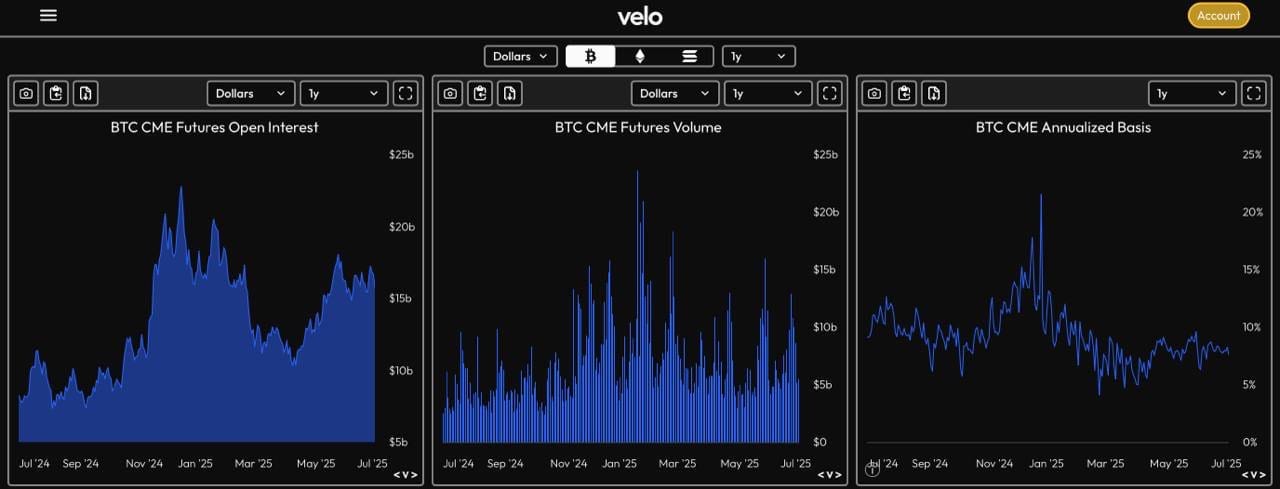

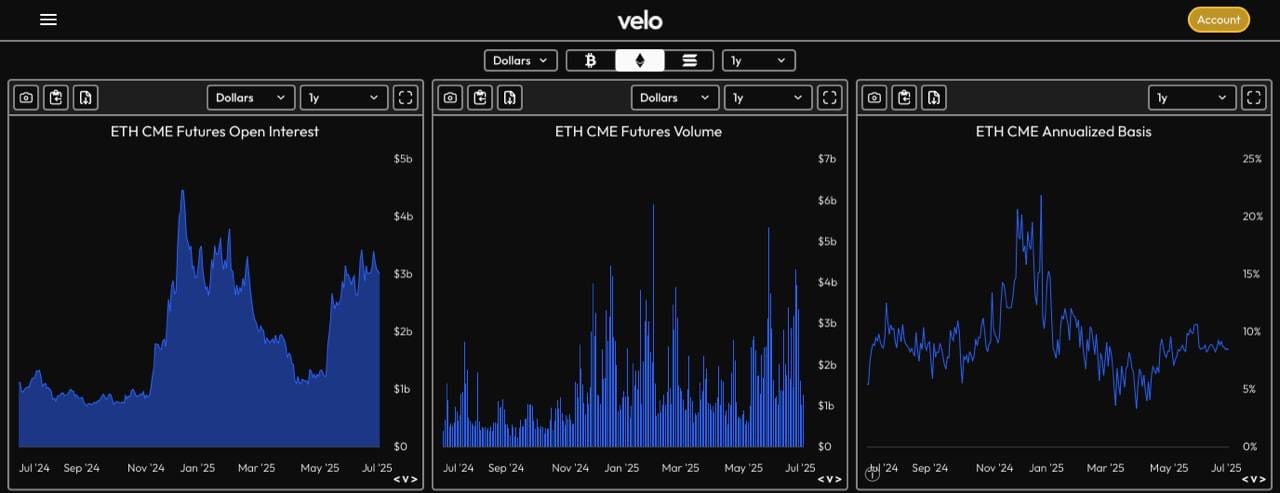

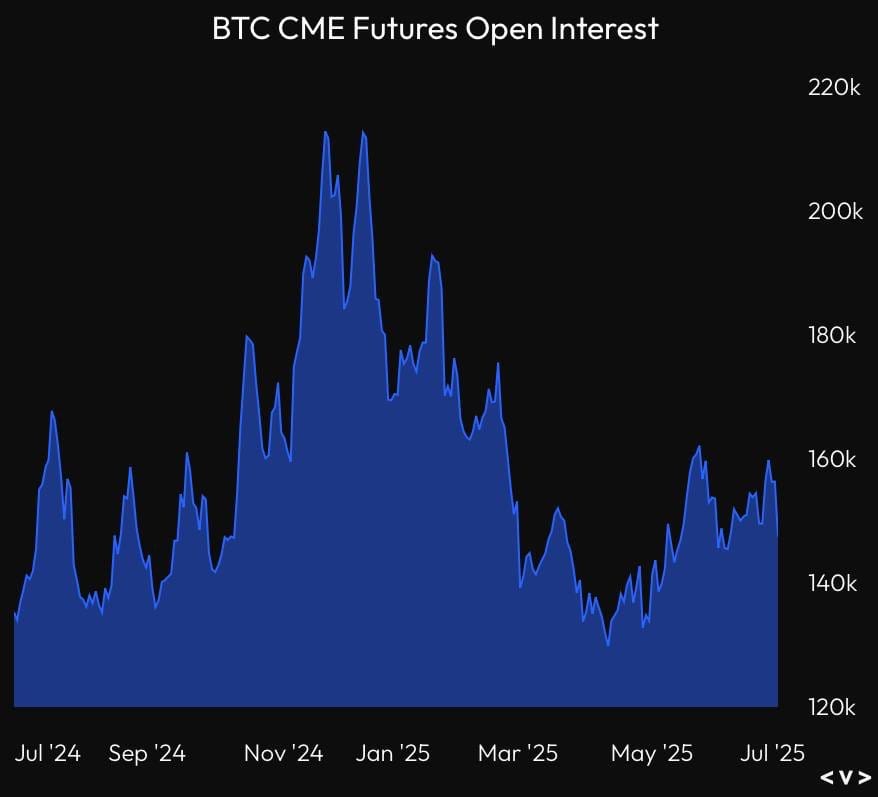

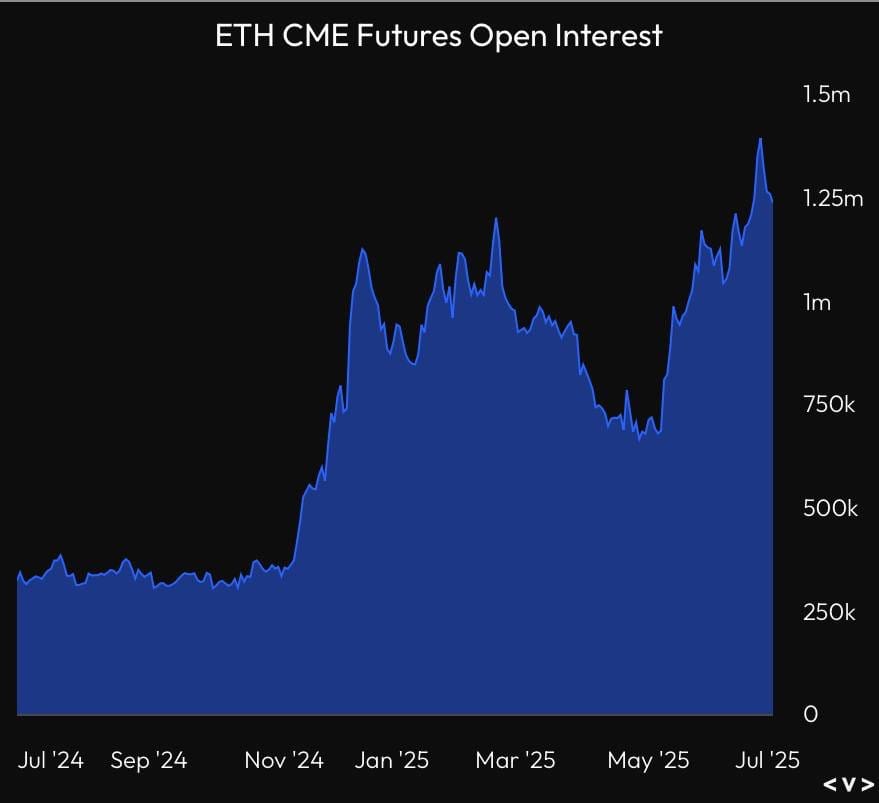

Let’s quickly beat a dead horse. Basis is dead. From the highs of mid 20% basis in the election season, to the freefall where we are now, it has been a wild ride. When basis spikes, please lock in some of these gains. It’s the most risk-free trade you can take to profit. Let’s look on the left in Open Interest. It has picked up significantly in both BTC and ETH in DOLLAR terms, but let’s now look below in COIN terms… In amount of coins, ETH is up at all time highs. There was a lot of speculation around ETH when it was near that sweet sweet 3k point looking for that push into 4k, but that has since been faded. It will be interesting to see if they hold for the minimal basis, or if they were speculating via long futures.

Charts from Velo: https://velodata.app/

Twitter: https://twitter.com/VeloData?s=20

Final Thoughts

As we look into 2025, Premia V4 aka Kyan will be launching. With portfolio margin and perps, it will be a great place to check out, trade, and compete in future competitions for rewards.

I wanted to continue the soft shill and give a little more insight. We have started integrating as a market maker on V4, we are working closely with the team in finding bugs. I’m told a few more weeks for a testnet launch that all of you will get to test out and enjoy. We would love all of your feedback. I’ll work with the team on finding the best way to share bugs and feedback from our readers. Maybe we can incentivize with some Marty hats for readers/testers.

For now, if you are interested in learning the basics of derivatives, please check out current edition of the academy here academy.premia.blue (currently undergoing maintenance, so some courses might be unavailable).

Thank you to all the readers who make this newsletter possible, we are sitting at about 4000+ email sign ups, and thousands of readers every 2 weeks. As for the Options Talk Show if you or someone you know wants to be a guest feel free to DM me, we are booking out July 2025 already!

Note: email sign ups get the newsletter 20ish minutes before.

Recap:

Vol Down, Price Flat

Political Drama Over 3T Deficit or Not

Testnet Launching Soon

21.2% Chance of Cut at Next FOMC

Trade on Premia: https://app.premia.blue/

Join The Marty Community Telegram: https://t.me/optionswithmarty

Mind you there is never a paid group, all information is free and we will never ask you for money. The Telegram is always free and provides a community for people to chat and learn.

Reply